Introduction to Property

Property, also known as real estate, refers to land, buildings, and other permanent improvements attached to the land. It is a valuable asset that can be bought, sold, and leased for various purposes. In this article, we will explore the different types of property, the benefits of property ownership, and the factors to consider when investing in property.

Types of Property

There are several types of property that individuals can invest in:

- Residential Property: This refers to properties used for living purposes, such as houses, apartments, and townhouses. Residential property can be rented out to generate rental income or be used as a primary residence.

- Commercial Property: Commercial property is used for business purposes, such as retail stores, office buildings, and industrial warehouses. Investing in commercial property can provide a steady stream of rental income and potential capital appreciation.

- Industrial Property: Industrial property includes factories, manufacturing plants, and distribution centers. This type of property is typically used for production, logistics, and storage purposes.

- Land: Land is an essential component of property. It can be used for development, agriculture, or conservation purposes. Investing in land can be lucrative if it is located in a high-growth area or has potential for rezoning.

Benefits of Property Ownership

Property ownership offers several benefits that make it an attractive investment:

1. Potential for Appreciation

One of the main advantages of property ownership is the potential for appreciation. Over time, property values tend to increase, allowing owners to earn profits when they decide to sell. However, it is important to note that property values can also decline in certain market conditions.

2. Rental Income

Owning rental property provides a reliable source of passive income. By renting out the property, owners can collect monthly rental payments that can cover mortgage costs or provide additional income. It is crucial to research the rental market and set competitive rental rates to maximize rental income.

3. Portfolio Diversification

Investing in property is a great way to diversify an investment portfolio. Property values are often not closely correlated with other asset classes, such as stocks or bonds. By adding property to an investment portfolio, investors can reduce risk and potentially increase returns.

4. Tax Benefits

Property ownership offers various tax benefits. Expenses related to property maintenance, repairs, and mortgage interest can be tax deductible. Additionally, if the property is held for a certain period of time, owners may be eligible for capital gains tax exemptions.

Factors to Consider When Investing in Property

Investing in property can be a lucrative venture, but it requires careful consideration. Here are some factors to keep in mind:

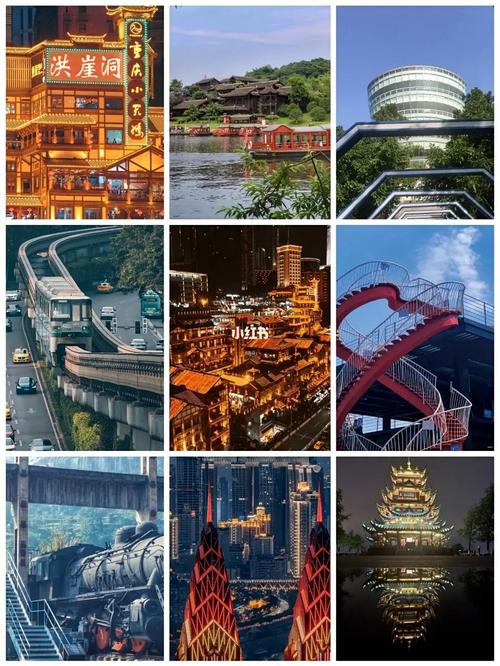

1. Location

The location of a property is crucial for its potential appreciation and rental income. Properties in desirable neighborhoods or areas with high population growth tend to have higher demand and can command higher rental rates.

2. Market Conditions

Evaluating the current market conditions is essential before investing in property. Understanding trends in property values, rental rates, and vacancy rates can help determine the potential profitability of an investment.

3. Financial Considerations

It is important to assess the financial aspects of investing in property. This includes evaluating the initial investment required, considering financing options, and conducting a thorough analysis of expected rental income and expenses.

4. Maintenance and Management

Property ownership entails ongoing maintenance and management responsibilities. This includes regular upkeep of the property, handling tenant-related issues, and ensuring compliance with local regulations. Owners can choose to manage the property themselves or hire a professional property management company.

5. Risk Assessment

Investing in property carries certain risks, such as changes in market conditions, economic downturns, or unexpected expenses. It is important to conduct a comprehensive risk assessment and develop contingency plans to mitigate potential risks.

Conclusion

Property ownership can be a rewarding investment with numerous benefits, including potential appreciation, rental income, portfolio diversification, and tax advantages. However, it is essential to carefully consider factors such as location, market conditions, financial considerations, maintenance and management, and risk assessment before investing in property. By conducting thorough research and making informed decisions, individuals can maximize the returns on their property investments.